Tally Can Now Help More Americans Pay Off Their Credit Card Debt for Good

Popular automated financial app expands service nationwide and lowers credit score requirement to make Tally credit line more accessible.

Tally

August 2, 2021

Americans today owe nearly $1 trillion in credit card debt collectively. The average household with credit card debt has a balance of nearly $7,000. Given the opportunity, many want to aggressively pay down their debt, which they did during the pandemic given the uncertainty and economic shutdown. But as people go back to their pre-pandemic spending habits and pandemic relief programs end, getting out of debt will likely become harder to do.

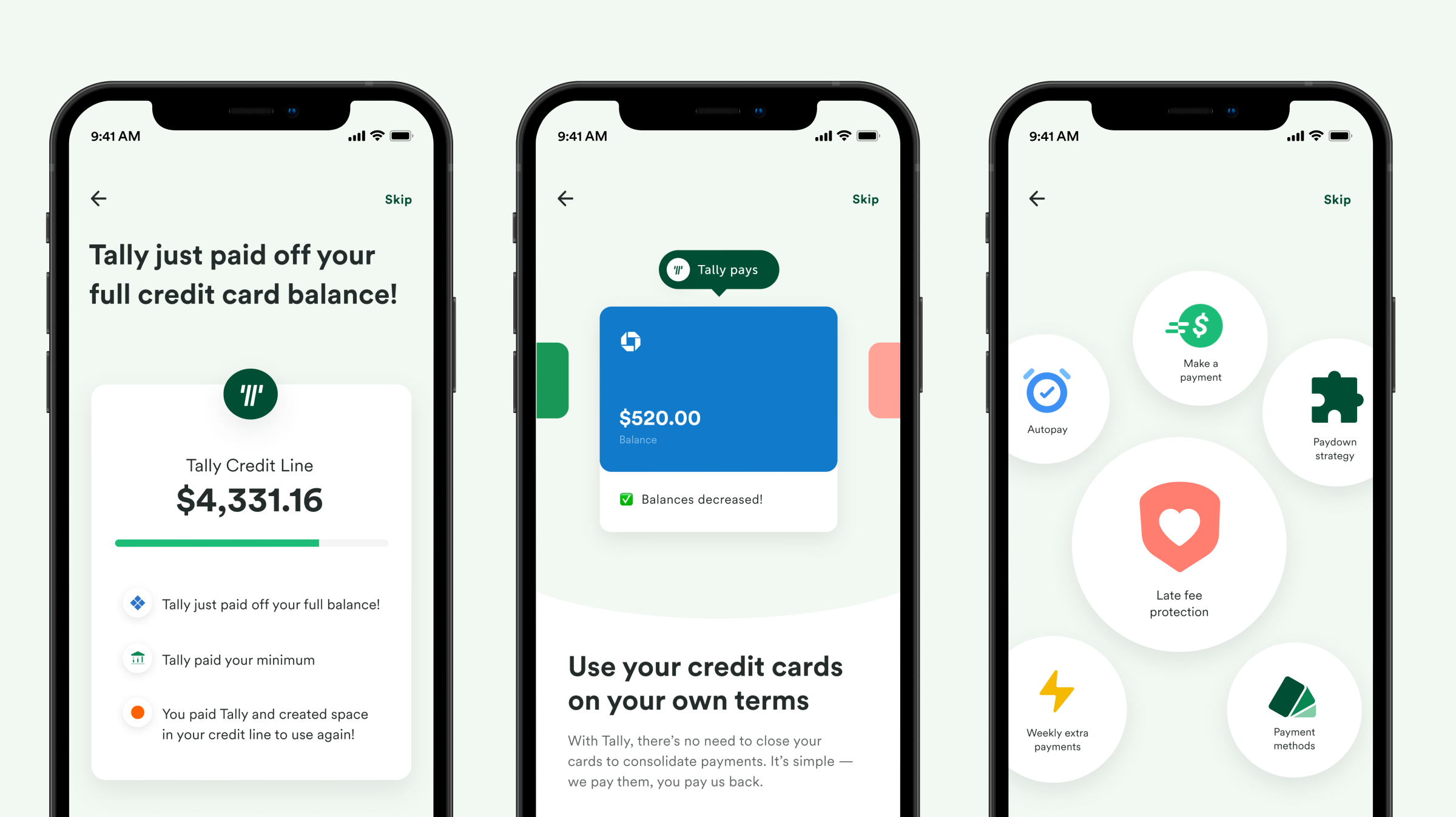

That’s where Tally comes in. Recognizing this heightened demand for financial stability, the company accelerated its plans to make its award-winning automated debt payoff app available to more people across the US regardless of their credit score.

Historically, Tally members needed a 660+ FICO score in order to use the app. Now anyone can use Tally’s automated debt manager to track and pay their credit cards in one place. Tally members will have access to customized payoff plans and smart recommendations for how much they should pay toward each of their cards every month.

Additionally, members with a credit score of 580 and above can now qualify for Tally’s line of credit at a lower interest rate than what their credit cards currently charge. This comes with late fee protection and provides a boost to help people pay down their credit card debt faster.

Since launching the first automated debt manager in 2017, Tally has been helping people pay off their credit card debt faster and saving them money on interest and late fees. To date, the company has raised $92 million from top investors including Andreessen Horowitz, Kleiner Perkins and Cowboy Ventures to automate people's financial lives.