What Is Dollar-Cost Averaging?

The concept of dollar-cost averaging is a strategy by which you invest a fixed amount of money in stocks or fund shares at regular intervals.

June 16, 2021

Investing is an exciting proposition for some people — they can’t wait to dive in and get trading. It can be an extremely stressful situation for others. The idea of putting their hard-earned savings at the mercy of the market might make their stomachs churn.

If you’re the first type of investor, you may be inclined to try and time the market, putting your money in all at once, crossing your fingers, and hoping you got it right. If you’re the second type of investor, you may be loath to put your money in the market at all. When you do, you may have the urge to pull it out at the first sign of volatility.

Depending on your personality and risk tolerance, these extremes may not be the best way to invest; it can be more useful to find a middle path. Enter dollar-cost averaging. What is dollar-cost averaging? The concept of dollar-cost averaging is a strategy by which you invest a fixed amount of money in stocks or fund shares at regular intervals. Doing so helps you smooth out your investing over time and avoid putting all your money in the market when prices are high. Here’s a closer look at how dollar-cost averaging works, dollar-cost averaging benefits, and how to get started.

Understanding Dollar-Cost Averaging

Dollar-cost average investing is a way to build wealth over a long period of time and a method for evening out the effects of volatility when purchasing stock or shares in index funds, mutual funds, or exchange-traded funds. When you dollar-cost average, you purchase shares with a fixed amount of money at regular intervals, such as once a month or once a quarter. Volatility is a natural part of the market cycle, so share prices at these periods will vary.

Sometimes you will make purchases when prices are high, in which case you will buy fewer shares. At other times, prices will be low, in which case you will be able to purchase more shares. Over time, these peaks and valleys even out. The increased number of shares you can buy when prices are low helps average out the effects of buying fewer shares when prices are high.

If you have a 401(k) through your employer, you may already be engaged in dollar-cost averaging. You’ve likely set up a predetermined amount of money that’s withheld from your paycheck and regularly invested in the mutual funds or index funds your plan offers.

In addition to helping smooth over the effects of volatility, dollar-cost averaging can help investors avoid the impulse to time the market and make emotional investing decisions. It is nearly impossible to predict market movements and identify the perfect time to buy. The consistent investing of dollar-cost averaging keeps investors from worrying about when to jump into the market. By the same token, it keeps investors from being swept away by emotions — excitement when markets are up or panic when markets are down — that might lead to costly mistakes.

Example of Dollar-Cost Averaging

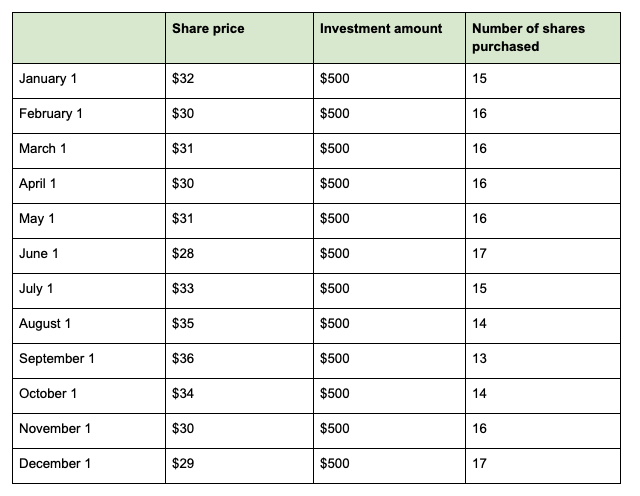

To better understand what dollar-cost averaging might look like, here’s an example. Say you decide to invest $500 in the same index fund on the first of every month over a year. Your dollar-cost averaging strategy might look like the following:

The cost of shares will vary from month to month, which means the number of shares you can purchase will also vary. When you invest a consistent amount each month, you can buy more shares when the market drops and fewer when it rises, averaging out to an overall lower share price.

In the example above, you can purchase 185 shares of the index fund at an average price of $31.58 per share. That’s much less than the $36 per share the index fund cost in September.

You may be asking yourself, wouldn’t it be better to invest the entire $6,000 in the market in June when share prices were at their lowest? While you would have paid less, it would not have been easy to predict that market low. Using dollar-cost averaging avoids timing the market but still results in an advantageously lower rate.

Downsides of Dollar-Cost Averaging

While dollar-cost averaging can be an extremely helpful tool for managing volatility and risk, it’s important to consider its drawbacks.

First, your broker may charge a transaction fee for trades, so buying shares of stocks and funds more frequently may increase investment costs. That said, many brokerages have decreased their fees or waived them entirely, in certain cases, which may make them less of a concern. What’s more, when you invest for the long-term, initial transaction fees become an increasingly smaller portion of your return, making them more manageable over time.

If the market is on the rise while you are practicing dollar-cost averaging, the other potential downside is missing out on gains you would have otherwise captured if you’d invested in a lump sum early on. While investors may be rewarded for lump-sum investing, they must be prepared for downside risk, the possibility that the market will fall after they invest.

Getting Started

Before you start investing, consider whether your money could do more good in pursuit of other financial goals. Carefully weigh the benefits of paying off high-interest credit card debt before you put money in the market.

One way to think about this is whether the interest rate you are paying on your card is larger than the return you think you would achieve in the stock market. Consider that credit card interest rates hover around 16%, while the average annual return of the S&P 500 over the last 20 years was about 6.4%. By paying off the high-interest rate debt first, you may get a bigger bang for your buck, decreasing the amount of money you spend on your debt faster than you might increase your savings by investing.

If your debt is under control and you’re ready to start dollar-cost averaging, see if your brokerage offers automatic investing. If they do, ask them to start investing a set amount of money regularly. If they don’t offer automatic investing, you can set up your own schedule to purchase stock. Choose dates that will be easy to remember, such as the first of every month, the beginning of every quarter, or the due date for quarterly taxes.

The Bottom Line for Investors

Suppose you’re looking for a way to reduce risk and get a handle on a tendency toward emotional investing. In that case, dollar-cost averaging could be the right strategy for you, even if you lose out on some potential upside. But before you start investing, consider taking care of other pressing financial goals, including controlling your credit card debt.

If you’re ready to tackle your debt, Tally may be able to help. Learn how you can pay down your debt faster to make room for other financial goals, like investing for the future.